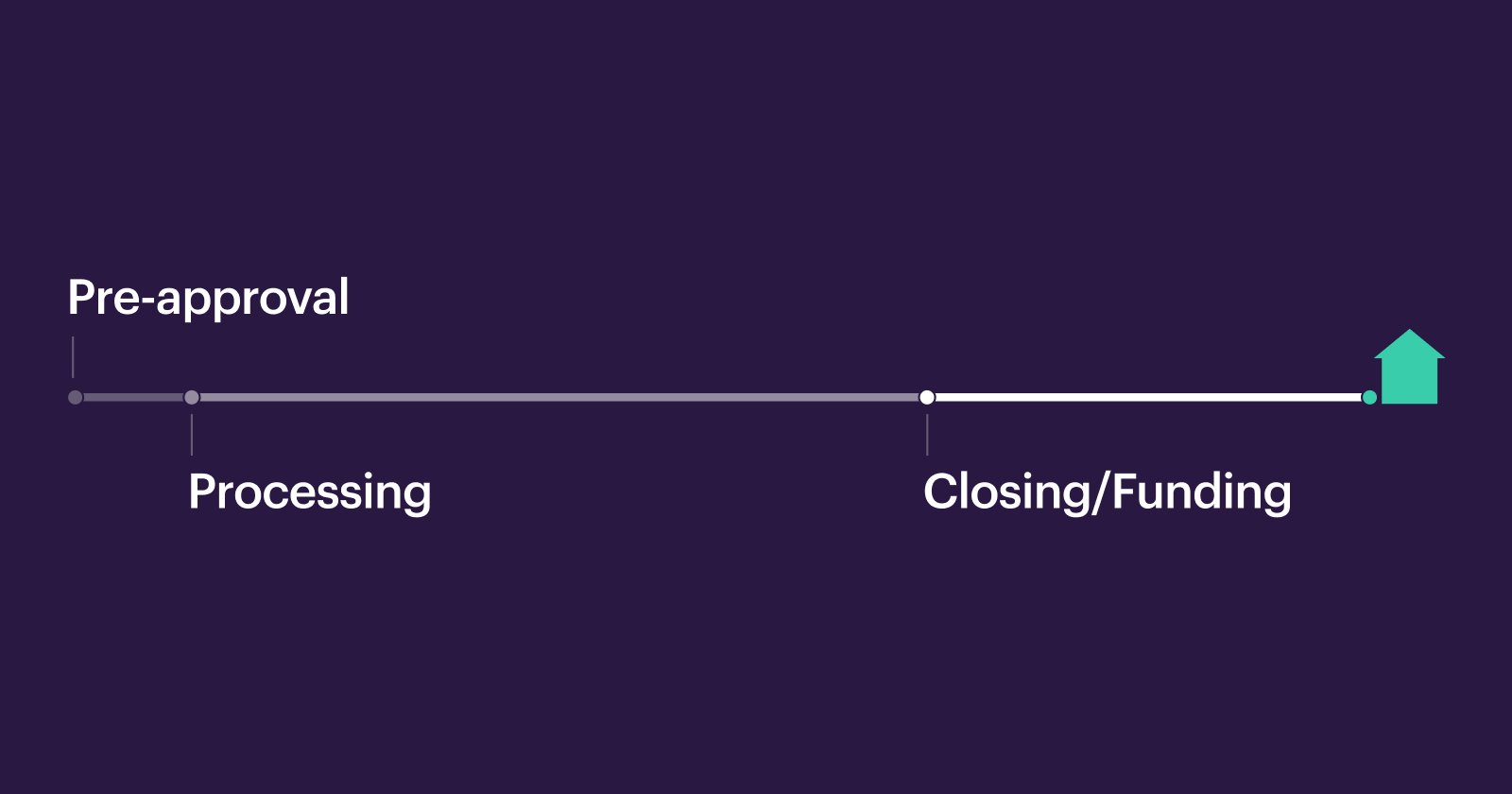

Your timeline for the homebuying process

Explore our detailed home buying process timeline to understand each step from pre-approval to closing and learn how to move forward with confidence.

Read more

Explore our detailed home buying process timeline to understand each step from pre-approval to closing and learn how to move forward with confidence.

Read more

Learn all about what a debt-to-income ratio (DTI) is, what a good debt-to-income ratio looks like, and why it matters when taking out a home mortgage.

Read more

Thinking about buying a second home? Learn key rules, lender requirements, and expert tips to qualify, secure financing, and buy your dream second home.

Read more

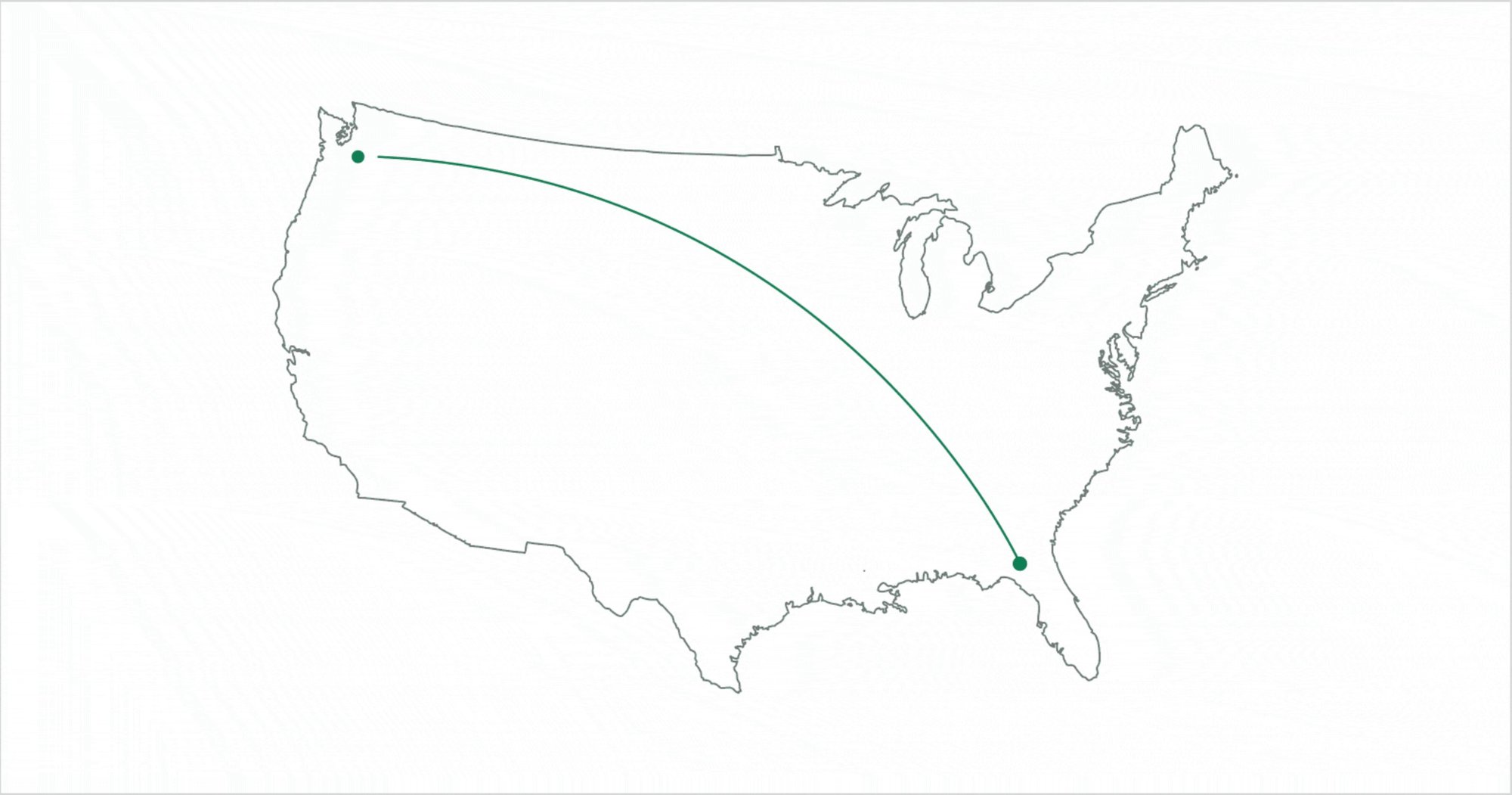

Buying a house out of state can be seamless with the right prep. Learn how to find an agent, compare homes, and close without setting foot in the state.

Read more

Learn what makes property value increase and learn 10 important factors that significantly impact how much a home is worth when buying, selling, or refinancing.

Read more

Looking for a house that truly fits your needs? Don't rely on a gut feeling. Get tips from a Better Real Estate Agent on how to know if a house...

Read more

HomeReady vs FHA loans: See how an affordable home financing program that offers low down payment options like HomeReady stacks up against FHA loans.

Read more

Each season has its pros and cons: We’ll help you identify your best time of the year to buy a house based on how you prioritize price, choice, and timing....

Read more

Mortgage application denied? Discover common reasons for denial and expert tips to strengthen your next application and boost your chances of getting approved.

Read more

Learn what a closing package is, why it matters, and how it finalizes your home purchase so you can confidently navigate the last step of the mortgage process.

Read more

Learn how a loan estimate reveals real mortgage costs, compares lenders, and highlights fees you can control. Explore its sections and compare offers clearly.

Read more

In the socially distanced world of 2020, Better helped 88,100+ new clients navigate their homeownership journey with ease, confidence, and a ton of savings.

Read more

Find out what makes Better a different kind of online mortgage lender. Our innovative technology, honest rates, and friendly humans are just the beginning.

Read more

Buying an investment property may be a great way to diversify your finances. Learn about investment property loans and other tips.

Read more

Many different types of mortgage loans exist, including fixed-rate, adjustable-rate, jumbo, FHA, and more, each with advantages for different homebuyers.

Read more

Many people are involved in the process of buying a home. You can expect to talk to everyone from a real estate agent to a loan consultant, and more.

Read more

Learn how to budget for your monthly mortgage payment with expert tips to manage finances, reduce stress, and stay in control of your homeownership costs.

Read more

Buying a house? Learn how your property type—primary residence, second home, or investment property—affects your mortgage rates, including investment property mortgage rates vs primary residence.

Read more

Learn the key homeownership lessons from a Better intern: insights that combine real estate expertise with early career development and first-time buyer tips.

Read more

Learn how to navigate buying a new construction home—from the home loan process, through assembling your team, and how you can avoid predatory lenders.

Read more

Need something else? You can find more info in our FAQ