A guide to refinance points

Refinancing your mortgage? You may want to buy down your interest rate by purchasing points, which can save you thousands over the life of your loan.

Read more

Refinancing your mortgage? You may want to buy down your interest rate by purchasing points, which can save you thousands over the life of your loan.

Read more

A guide to navigating first time homebuyer loans, grants, and programs to make sure you get the most bang for your buck.

Read more

A new announcement from the Federal Reserve could mean the end of low rates—but that may not be bad news for buyers and homeowners.

Read more

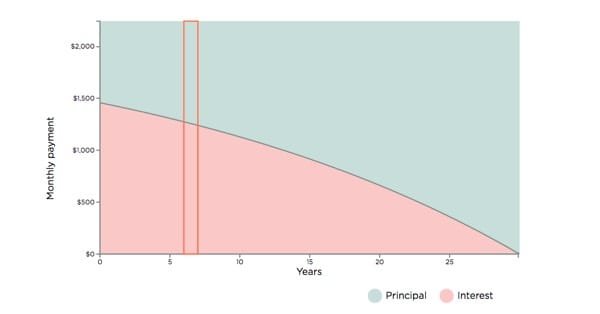

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

A lot goes into making an offer on a home. Here are the 6 steps—from determining your price to sealing the deal.

Read more

Home prices continue to rise, but the holiday season could spell opportunity for some. See multiple ways first-time buyers can get a competitive edge.

Read more

Buying your first home? Don’t fall into these 6 common mistakes. Get expert advice to help you make better choices from the start.

Read more

Learn how rising inflation influences current refinance mortgage rates, where they may be headed next, and why acting fast could save you money.

Read more

Ready to buy a home? Learn how to get serious about your house hunt with practical tips on budgeting, pre-approval, and navigating a competitive market.

Read more

Homebuyers are paying more at closing than they did in 2020, but choosing the right lender and loan options can help you save on a new home.

Read more

Closing costs are going up around the country, but choosing the right lender can help you save more on a new loan.

Read more

Learn how to win a real estate bidding war in a competitive market by understanding contingencies, using smart offer tactics, and proven strategies that work.

Read more

Wondering what are points on a mortgage? Learn how they work, how buying points lowers your interest rate, and whether they can truly save you money over time.

Read more

We looked at notable design trends over the past 100 years to see how American homes have changed.

Read more

Here’s how much home prices and average interest rates have risen since 1950.

Read more

To help buyers keep up with record high home prices, the FHFA is raising the limit on conforming loans—and it could help you save on a home.

Read more

With property values rising, today’s homeowners are in a good position to refinance with new terms that remove private mortgage insurance.

Read more

Jumbo loans are mortgage loans that have a higher-than-normal balance. Here's what you need to know about securing this type of financing in 2021.

Read more

Homeowner credit scores are at their highest in 15 years, and with new Fannie Mae rules, they could go further on a refinance application.

Read more

Learn the differences between jumbo vs conventional loan types, county loan limits, qualifying guidelines, and how to know if you should consider a jumbo loan.

Read more

Need something else? You can find more info in our FAQ